This product is provided to Travel Insured by goodtogoinsurance.com who are appointed representatives of Ancile Insurance Group Ltd who are authorised and regulated by the Financial Conduct Authority – no.471641 By clicking the box at the foot of this page, you will be taken to our dedicated travel insurance site provided by goodtogoinsurance.com where you will be able to get a travel insurance quotation and view full policy information. The quotation you will obtain is provided on a non advised basis which means that no advice is given or implied and you are solely responsible for deciding whether the policy is suitable for your needs. Contact us if in doubt or if you require advice.

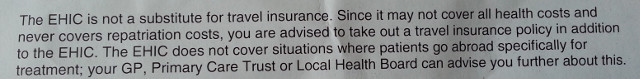

This insurance would meet the demands and needs of someone who wishes to insure their trip away from their home for cancellation costs, medical expenses and other specific risks required for that trip according to their individual circumstances..

If you experience any problems when using the site, contact us on 0845 850 1066.

I have read and understood the above detail

This product is provided to Travel Insured by Ancile Insurance Group Ltd who are authorised and regulated by the Financial Conduct Authority - no.471641. By clicking the box at the foot of this page, you will be taken to our dedicated travel insurance site provided by Ancile Insurance Group Ltd where you will be able to get a travel insurance quotation and view full policy information. The quotation you will obtain is provided on a non advised basis which means that no advice is given or implied and you are solely responsible for deciding whether the policy is suitable for your needs. Contact us if in doubt or if you require advice.

This insurance would meet the demands and needs of someone who wishes to insure their trip away from their home for cancellation costs, medical expenses and other specific risks required for that trip according to their individual circumstances..

If you experience any problems when using the site, contact us on 0845 850 1066.

I have read and understood the above detail.

This product is provided to Travel Insured by Ace European Group Ltd who are authorised and regulated by the Financial Conduct Authority – no.202803. By clicking the box at the foot of this page, you will be taken to our dedicated business travel insurance site provided by Ace European Group Ltd where you will be able to get a travel insurance quotation and view full policy information. The quotation you will obtain is provided on a non advised basis which means that no advice is given or implied and you are solely responsible for deciding whether the policy is suitable for your needs. Contact us if in doubt or if you require advice.

This insurance would meet the demands and needs of a business which wishes to insure business trips away from the UK for cancellation costs, medical expenses and other specific risks required for that trip according to their individual circumstances..